Solana is one of the fastest-growing ecosystems for real-world assets (RWAs). The RWA sector has ballooned from $5B in 2022 to over $31B in 2025, with Solana alone hosting nearly $700M in RWAs and over $13.5B including stablecoins, representing nearly 500% year-over-year growth.

Now Solana is entering its next chapter: real-world yield.

Solana’s key advantage is its scale, having one of the largest and most active retail user bases in crypto. For Plume, whose mission is to make real-world assets accessible to everyday people rather than only institutions, this makes Solana one of the strongest distribution platforms in the industry.

This is exactly why Plume chose Solana for its first multi-chain expansion of Nest.

Get Started:

- Connect your Solana wallet

- Choose a Nest vault

- Deposit stablecoins

- Receive your Nest token

- Deploy it across Solana DeFi and earn Nest Points

Plume brings compliant RWA infrastructure and institutional pipelines. Solana brings the user base and interfaces that turn real-world yield into a mainstream, retail-scale asset class.

Together, we form the foundation of a scalable real-world yield economy.

Solana’s RWA Ecosystem Today

Solana’s RWA stack is early but accelerating across three major segments: Tokenized treasuries, private credit, and short-term receivables.

- Tokenized Treasuries: The most mature segment, anchored by government-backed, low-volatility yield.

- Private Credit: The fastest-growing area, with institutional managers bringing diversified credit funds and private lending strategies onchain.

- Short-Term Receivables: An emerging segment offering cashflow-driven, short-duration income.

One core challenge to scaling RWAs on any blockchain is a truly comprehensive real-world asset yield layer. Assets can exist onchain, but they are often fragmented across issuers and not composable across the broader ecosystem.

This is where Plume shifts the landscape.

Plume unifies issuers, protocols, user distribution, and yield infrastructure into a single asset layer on Solana. By consolidating institutional RWAs into accessible, liquid, interoperable products, Plume transforms Solana’s early RWA momentum into a functional, scalable real-world yield economy.

Solana has built the performance layer. Plume brings the asset layer.

Together, we create the yield layer.

Introducing Nest: the base layer of real-world yield on Solana

Nest is Plume’s stablecoin yield platform: a suite of institutional-grade RWA vaults that return liquid, yield-bearing tokens which grow as real-world income accrues.

On Solana, Nest operates as a native yield layer. Users deposit stablecoins into Nest vaults and receive a yield-bearing Nest token that accrues value over time and can move seamlessly across Solana DeFi protocols.

Nest vaults launching on Solana include:

- nTBILL → tokenized U.S. treasuries

- nOPAL → short-term receivables

- nBASIS → delta-neutral yield from basis trading

- nWISDOM → private credit from real estate, technology, and private equity

- nALPHA → diversified selection of tokenized assets selected by Cicada

Nest tokens provide:

- Simple access to institutional RWAs

- Stable, real-world yield opportunities

- Full composability across Solana DeFi

- Eligibility for Nest Points, rewarding long-term participation

With Nest, Solana gains a unified, scalable base layer for real-world yield. Plume is actively expanding the Solana DeFi ecosystem with sustainable, composable yield infrastructure

How Plume Connects to Solana’s RWA Ecosystem Partners

Plume doesn’t just bring RWAs to Solana, it connects them into the broader Solana infrastructure so users, builders, and DAOs can actually compose within DeFi amplify real-world yield.

Here’s how these pieces fit together on Plume:

1 Loopscale: Amplifying Yield with Borrowing & Looping

Loopscale provides a modular looping engine; Plume provides the yield-bearing assets (Nest tokens). Together, we enable users to:

- Borrow against yield-bearing RWAs

- Redeploy capital back into Nest vaults

- Stack real-world yield multiple times

- Execute high-efficiency strategies at Solana speed

2 Altitude (by Squads): RWA Access for Crypto Native Treasury Managers

Global businesses use Altitude to access institutional credit with just a few clicks. Plume makes its Nest vaults accessible directly inside Altitude so businesses can:

- Hold institutional-grade RWAs natively

- Diversify treasury assets into predictable income

- Manage real-world yield positions with enterprise-grade controls

With the Altitude Earn, businesses can gain exposure to public and private credit funds from issuers like WisdomTree and Hamilton Lane through Plume’s Nest vaults.

These credit strategies are relied on by the world’s largest allocators but have traditionally been inaccessible to global companies due to prohibitive capital requirements and exclusive access.

3 Asset Issuers: Bringing Institutional Products OnChain

Plume integrates with institutional issuers offchain and brings their assets onchain for Solana users to access. Issuers include:

- WisdomTree

- Hamilton Lane

- Securitize

- Superstate

Plume handles regulatory-grade custody, disclosures, and asset pipelines. Solana simply receives liquid, tokenized, composable yield products ready to use across DeFi.

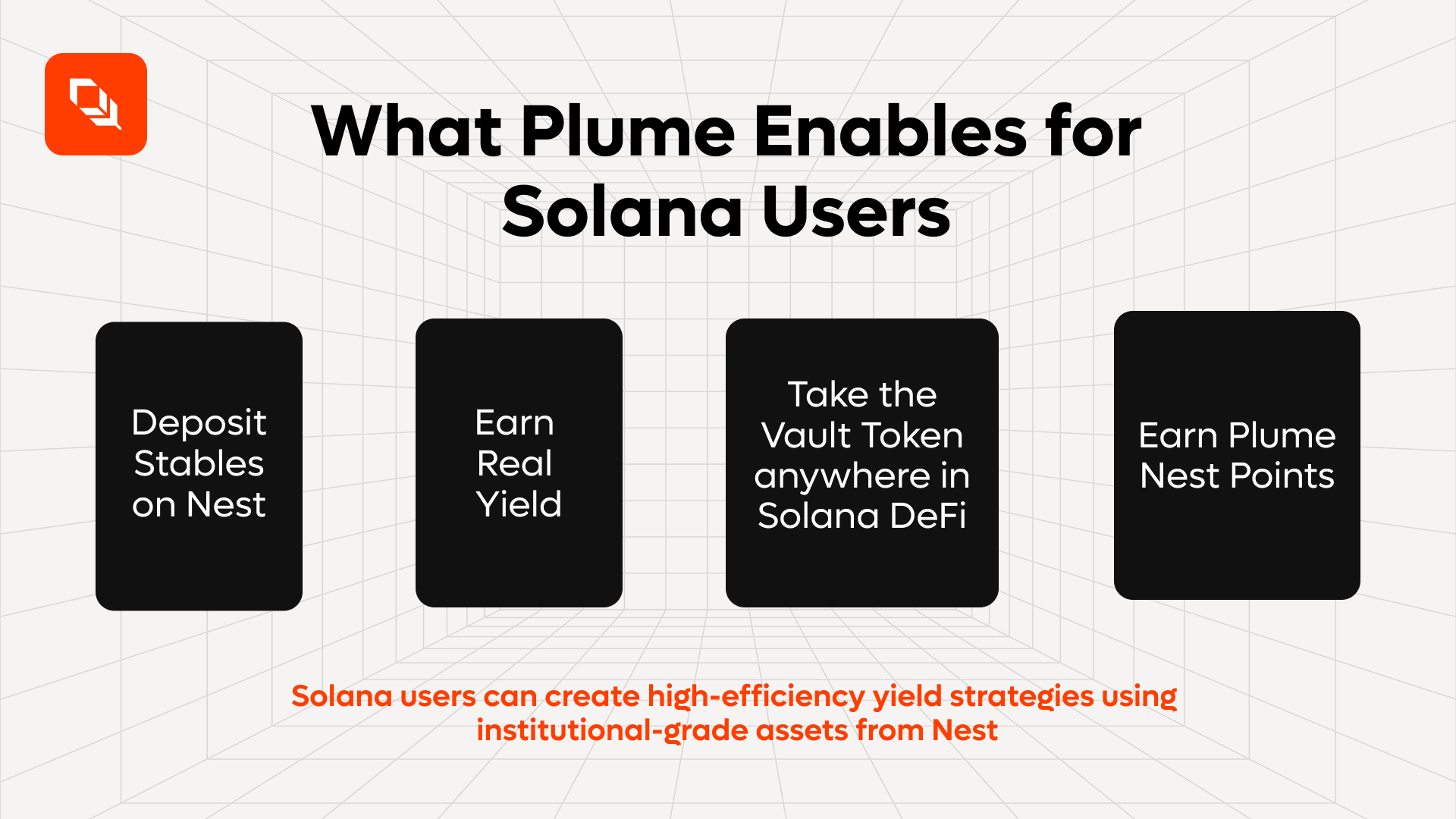

What This Unlocks for Solana Users

Plume enables RWAs on Solana to become simple, stable, composable, and amplifiable. This shifts Solana from a primarily zero-sum trading environment into one that produces real economic surplus.

Solana already excels at performance and user experience. Plume adds the missing piece: stable, scalable, real-world yield.

This is the beginning of Solana’s real-world yield era, powered by institutional-grade assets from Plume and made accessible to everyone through Nest.

Disclaimer: Plume Services are not available to U.S. persons or residents. Crypto trading involves high risk, including potential loss of all principal. Looping (leverage) strategies amplify these risks and carry a significant chance of substantial principal loss, up to and including the total loss of your entire holdings, due to market volatility, liquidation events, and compounding borrowing costs. Past performance is not indicative of future results. There are no guarantees of profits, returns, or yields. Information is for educational purposes only—Plume makes no representations or warranties on its accuracy, completeness, suitability, or value. This is not financial advice; consult professionals.