The Plumeberg News – Goldman Joins Tokenization Race, SEC Roundtable, and BlackRock Eyes Staking ETPs

.avif)

This week, real world asset (RWA) tokenization moved further into the institutional spotlight as Goldman Sachs, BlackRock, and the U.S. SEC took center stage. With plans for digital asset trading expansion, strategic discussions around staking in ETPs, and an official roundtable on tokenization, it's clear that both Wall Street and Washington are actively laying the groundwork for next-gen financial infrastructure powered by blockchain.

1)Weekly RWA Highlights

Goldman Sachs to Expand Digital Asset Trading and Tokenization Strategy

At TOKEN2049, Goldman Sachs revealed plans to expand its digital asset trading, explore crypto lending, and significantly invest in tokenization infrastructure. According to Mathew McDermott, Global Head of Digital Assets, client demand for exposure to digital assets is growing rapidly. Goldman now aims to secure regulatory approval to move beyond secondary markets and actively engage in onchain collateral management and real world asset tokenization.

Read More: Binance News

SEC Schedules Fourth Crypto Roundtable Focused on Asset Tokenization

The U.S. Securities and Exchange Commission (SEC) has published the agenda for its fourth crypto roundtable, titled “Tokenization: On-Chain Asset Migration—The Intersection of Traditional Finance and DeFi.” Set to take place in Washington, D.C., the event will convene legal, regulatory, and industry stakeholders to discuss how blockchain tokenization of real world assets can coexist with traditional financial systems.

Read More: Binance News

BlackRock Discusses Staking ETPs and Tokenized Securities With SEC Task Force

In a memo released May 9, BlackRock and the SEC Crypto Task Force met to discuss integrating staking into exchange-traded products (ETPs) and the evolving framework for securities tokenization. As the issuer of one of the most successful ETH ETPs, BlackRock expressed interest in enhancing product utility by including staking capabilities. The dialogue underscores growing institutional appetite for tokenized investment products with real yield mechanics.

Read More: Cointelegraph

2)RWA Market Commentary

This week’s momentum shows clear alignment between institutional finance and regulatory bodies around the future of tokenized assets. Goldman Sachs’ expansion plans represent one of the most direct moves yet by a Tier 1 bank into primary RWA operations, signaling rising client demand and internal conviction.

Meanwhile, the SEC’s formal roundtable and engagement with BlackRock on staking-enabled ETPs confirms that tokenization and staking are now top-of-mind at the highest levels of U.S. financial policy. The focus is no longer just on whether tokenization will happen—it’s now about how it will be integrated into the regulatory and product design frameworks that govern traditional finance.

As these discussions mature, expect tokenization to move from pilot initiatives to regulated, yield-generating investment products—with staking, collateral liquidity, and real world asset backing as key components.

3)Narrative Overview

RWA Index Ranking (29.30%)

4)Tokenized Assets Analytics

Global Market Overview:

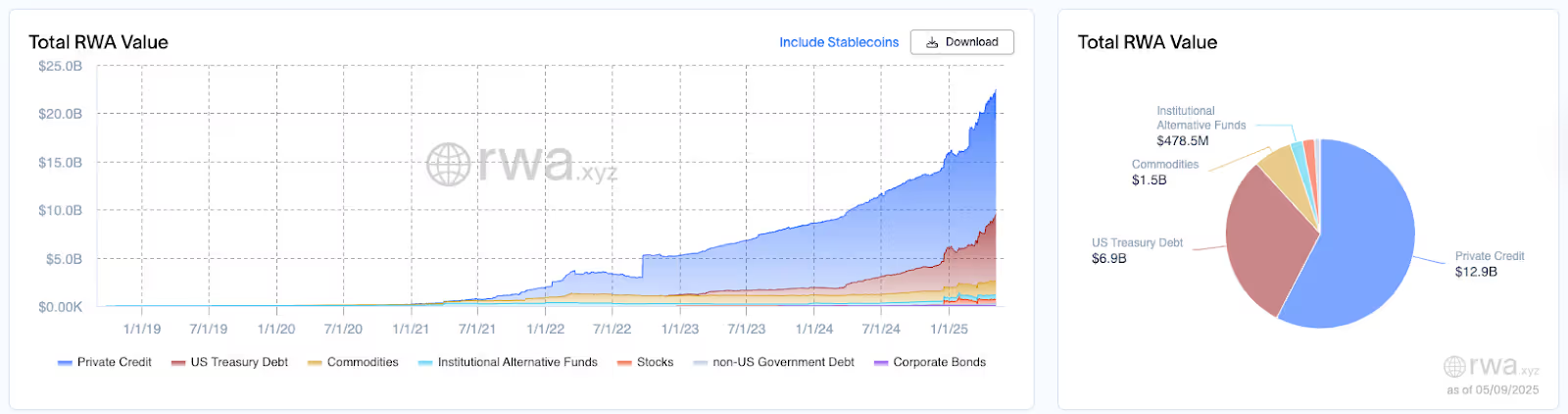

- Total RWA Onchain: $22.46B (+9.3% from 30d ago)

- Total Asset Holders: 100,657 (+5.71% from 30d ago)

- Total Stablecoin Value: $231.56B (+2.04% from 30d ago)

Conclusion

The convergence of Goldman Sachs’ strategic expansion, BlackRock’s push for staking utility, and the SEC’s proactive dialogue on RWA tokenization marks a watershed moment for the sector. As the narrative shifts from exploration to execution, both infrastructure and policy are catching up to the promise of onchain asset finance.

With regulatory clarity emerging and demand for tokenized products on the rise, we’re now entering a phase where Wall Street is not just watching tokenization—they’re building with it.