The reality of DeFi yield is simple: if you don’t know your assets, you can’t trust your yield.

Nest, the RWA yield protocol by Plume, was built to fix that.

Transparent vaults, real institutional assets, and verifiable yield flows. No more black-box DeFi strategies of the last cycle.

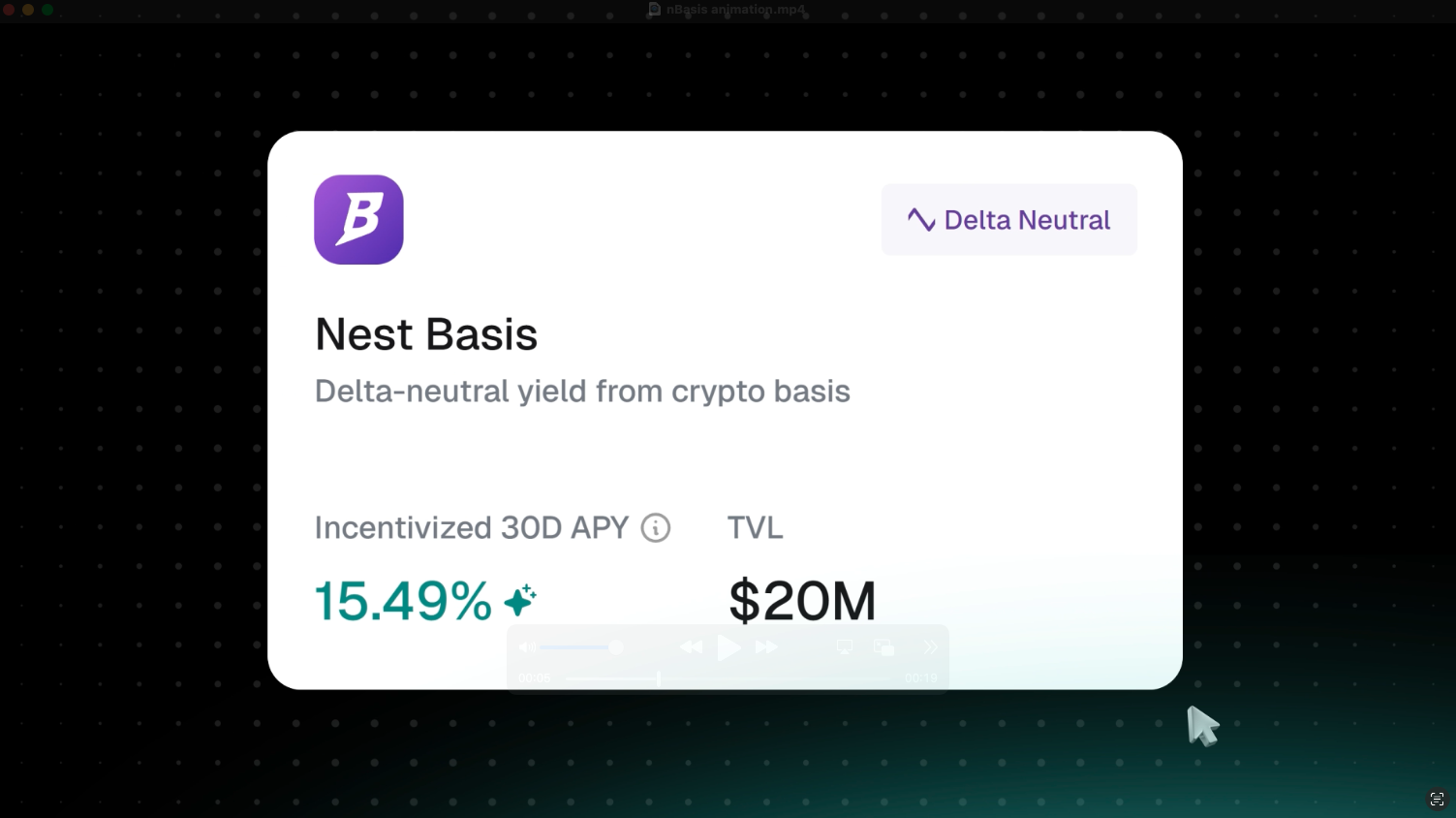

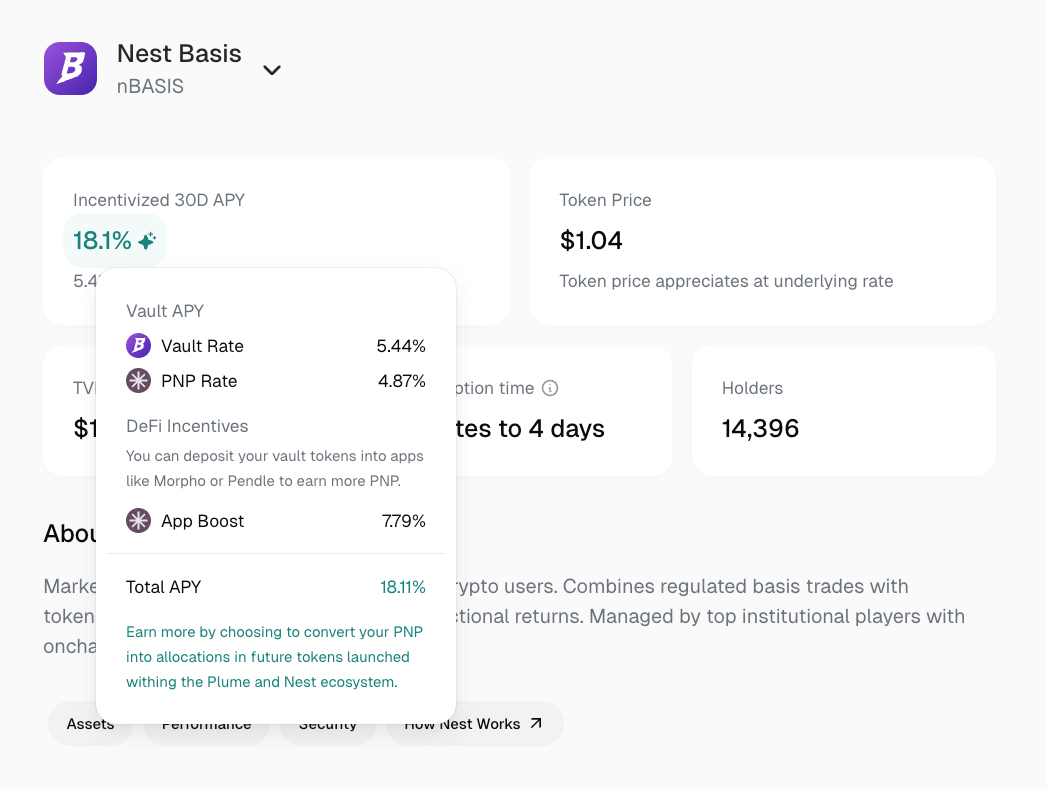

Today’s Nest Asset Highlight focuses on Superstate, the issuer behind two of the most mature tokenized funds onchain, and the backbone of nBASIS, Nest’s most widely held RWA yield vault with more than 14,000+ users and $20M TVL.

What Powers nBASIS?

nBASIS delivers predictable, market-neutral yield using transparent real-world assets. No guesswork about where returns come from.

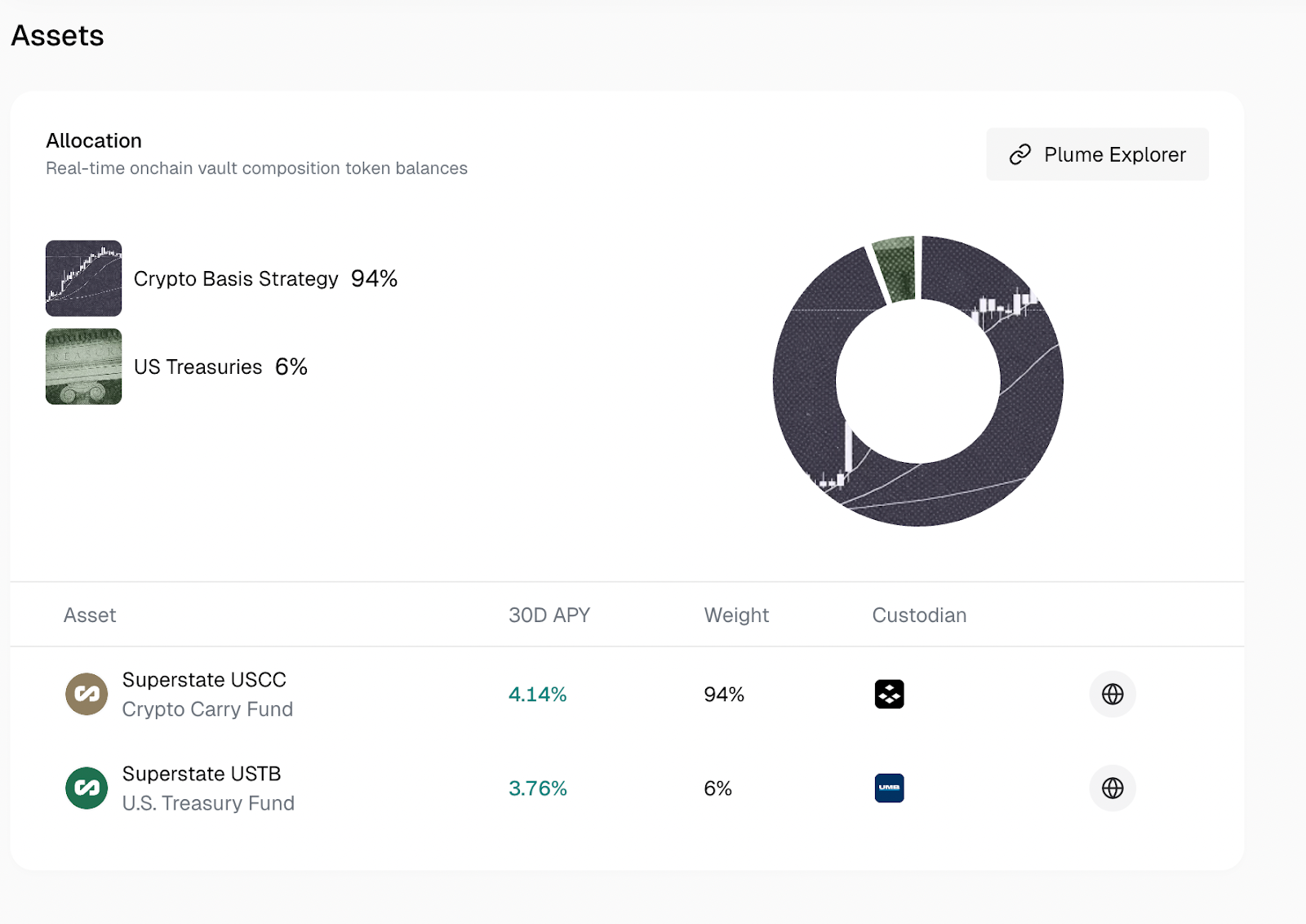

The vault is built on two institutional-grade Superstate funds:

Superstate USCC (Custodied via Anchorage Digital)

USCC is the primary yield engine. It generates stable, market-neutral income through BTC/ETH/XRP/SOL basis trades primarily through CME futures, a long-standing institutional strategy that captures the futures premium without taking directional market risk.

→ See up-to-date list of assets available from USCC

Superstate USTB (Custodied via Bank of New York Mellon)

USTB acts as the vault’s stability layer, holding short-duration U.S. Treasuries. These government-backed instruments provide low-volatility fixed-income yield and smooth out performance across market cycles.

USTB acts as the vault’s stability layer, holding short-duration U.S. Treasuries. These government-backed instruments provide low-volatility fixed-income yield and smooth out performance across market cycles.

→ See up-to-date list of assets available from USTB

Access to Real-Time Transparency

If your vault is a black box, your yield is too. nBasis is transparent and audited so you always know where your money is invested.

The Nest UI displays:

- Real-time asset composition

- Fund-level APYs

- Custodian details

- NAV-based token price

- Clear redemption timelines

- Boosted yield opportunities

This removes the ambiguity of “trust us” vaults that dominated the last cycle.

With Nest, you know:

- What assets back your yield

- How much each contributes

- Where they are custodied

- How the vault performs daily

Transparency isn’t a feature; it’s the foundation.

Risk Controls & Trust Layer: Cicada Trust

Nest uses the Cicada Trust framework to improve transparency around RWAs:

- Curates and validates underlying assets

- Confirms proportional ownership

- Conducts due diligence on asset managers

- Verifies NAV data

- Creates cryptographic proofs instead of opaque reporting

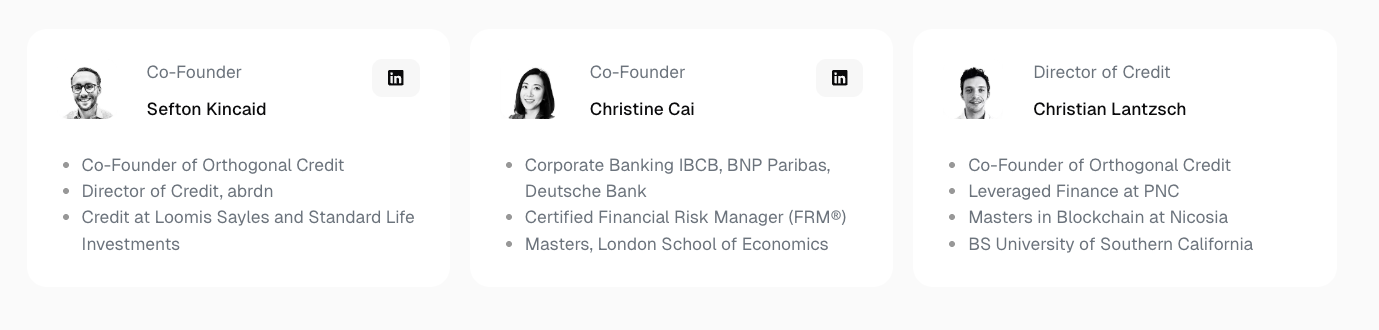

The underwriting team at Cicada has over 35 years of experience in traditional and on-chain credit markets, successfully underwriting over $1B+ in loans.

This is how you bring real-world trust assumptions into programmable finance.

Why Superstate Chose Nest

The role Superstate plays in nBASIS goes beyond asset exposure. It reflects a deliberate decision to use Plume and Nest as the infrastructure layer for distributing institutional-grade assets onchain.

As Superstate expands its tokenized funds beyond a single chain, Plume’s RWA-native design and Nest’s transparent vault framework provide the environment required to support compliance, liquidity, and composability at scale.

With 280K+ RWA holders (the largest global ecosystem), Plume was a perfect fit to bring Superstate’s institutional-grade assets onchain, and continue to partner with the tokenized fund leader.

Earlier this year, Plume was selected as the first multichain expansion partner for Superstate, and we’re proud to continue deepening our partnership on the nBASIS vault with Superstate funds as the backing asset.

“Superstate’s goal is to bring institutional-grade tokenized assets to every major blockchain, and by first expanding to Plume, the unique RWAfi chain provides an opportunity to demonstrate how purpose-built infrastructure can enable great new use-cases for tokenized assets.” - Robert Leshner, CEO of Superstate

Nest enables accessibility, transparency, and composability for everyday users. Together with Superstate, we’re setting a new standard for trusted real-world yield.